Is the Market Going to be Up or Down in 2020?

I have been getting this question a lot lately, online, on the phone, in text, in email, you name it...I've answered it.

Probably a good time to put it into a blog post so maybe I can just send this along instead of customizing each response....oh who am I kidding, I'm far too long winded to let that happen.

But, if you are a reader of this RE Insiders blog then buckle your seatbelt, it's going to be a bumby ride!

The Current Real Estate Market in Calgary

Sales are up.

Sales are down.

Prices are up.

Prices are down.

I could just leave it there but what kind of a scribe would I be if I just left you hanging with no further information?

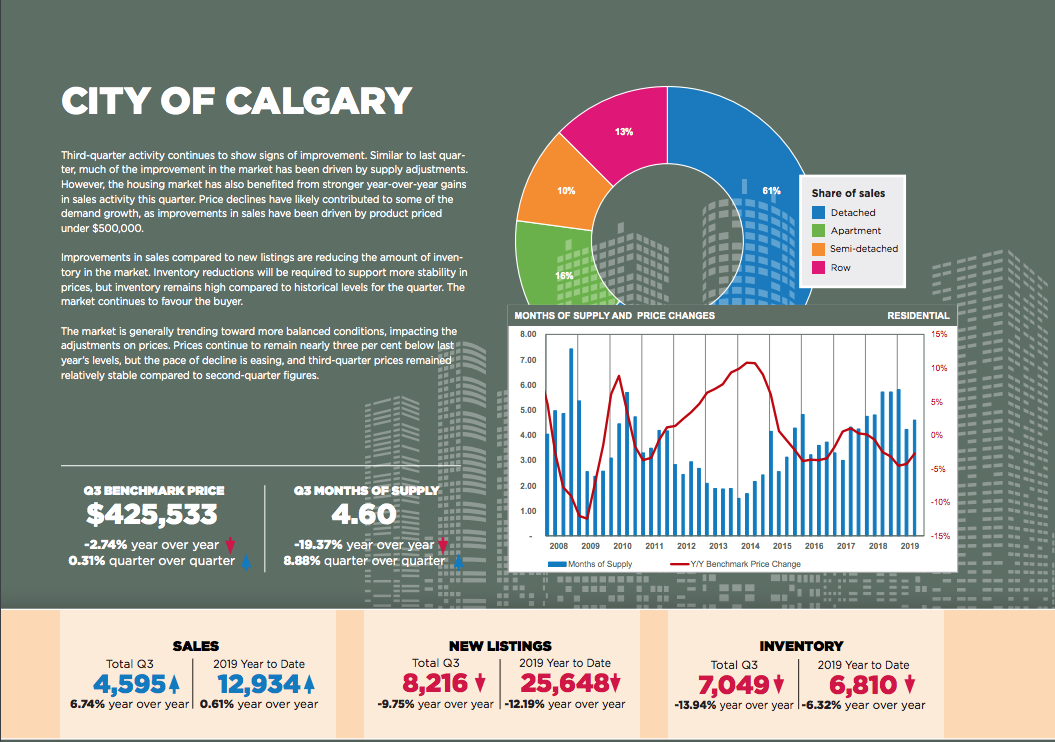

Overall the sales activity in Calgary has been positive in comparison to 2018.

Sales are up almost 7% year over year with the number of overall listings trending downward, with numbers coming in around 12.2% below 2018 numbers.

So, sales up, listings down....we are in a balanced market right? Maybe a seller's market?

Nope, not the case.

You would think the numbers above would reflect that but overall we are still planted in a buyer's market with the winter market trending in the right direction.

Where are we Headed? Excuse me While I Whip Out my Crystal Ball

Oil prices are likely to stay where they are at.

We will likely see 10,000 people move to Calgary this year.

Interest rates will likely stay put as well, as there is a lot of talk of another recession (when has Alberta been out of it??).

That market is going to be flat, there isn't going to be a massive bump in pricing up or down. Even if we saw a massive war in the Middle East or some kind of embargo like the 1970s and oil prices took a massive swing upwards, the market here still wouldn't be affected for upwards of 18 months.

Unsure of those numbers? Have a look at recent history with the swings that we saw between 2005-2008. What happened in 2008?

Yes the US housing market took a massive nosedive off the Empire State Building, but that wasn't it.

Oil prices also took a nosedive. The same thing happenened in 2014.

Our real estate market saw drops in prices and massive spikes in inventory in 2010 and 2016 respectively. Coincidentally, oil prices started to drop off in October of 2008 and 2014 and we didn't see declines for at least 18 months.

So....crystal ball, what say you?

The only way our market sees a massive uptick is if the economics of our region start to drastically improve (think overnight), and even then, we won't see the affect on the real estate market here in Calgary until at least the end of 2020 to mid 2021.

Advice for Buyers in Calgary

The major thing to note is that we will see a significant change in new inventory coming to market in comparison to what we've seen over the last little while.

To put this in perspective, there is a good chance that November will have 500 fewer homes hit the market and in December we will likely see 1,000 fewer homes than what we experienced in the month previous.

The new listing number drops off significantly faster than the drop in total sales, which simply means that you shouldn't be surprised that it might be busier despite us moving further into the slow months.

If you are purchasing in the lower price points, it could catch you by surprise.

Advice for Sellers in Calgary

Entering the month of November seller's need to be aware that this is their last chance at the highest number

of buyers to see their home until February and onward.

The months of December, January and February, over the last few years have seen significant drops in sales, this next year will be no different.

If you are on the market or coming to market you should forget about testing the market, you must be aggressive with your pricing and make sure that selling over the winter is something that you absolutely want to do.

No BS. Straight Talk

Look, if you want someone to blow smoke, I'm not the guy.

I am going to tell you like it is. If you don't have to sell then pull your house off the market until things improve.

If you want to buy, the bottom is close and you would be wise to think seriously about pulling the trigger.

Want to grab a coffee or a beer?

Emai me kelley@kelleyskar.com or shoot me a text at 403-827-7527

Comments:

blog comments powered by Disqus